Unlocking Financial Freedom with Merchant Cash Advances from Blursoft

Are you a small commercial enterprise proprietor searching out flexible financing options? Enter the world of Merchant Cash Advances (MCAs) with Blursoft. This blog submit will guide you thru the fundamentals of MCAs, spotlight their advantages, and display how Blursoft is revolutionizing this monetary answer. We’ll also share achievement testimonies, provide a step-with the aid of-step software guide, and evaluate MCAs with conventional loans. By the give up, you may understand why MCAs are a powerful tool for corporations and the way Blursoft stands out in the market.

Introduction to Merchant Cash Advances (MCAs)

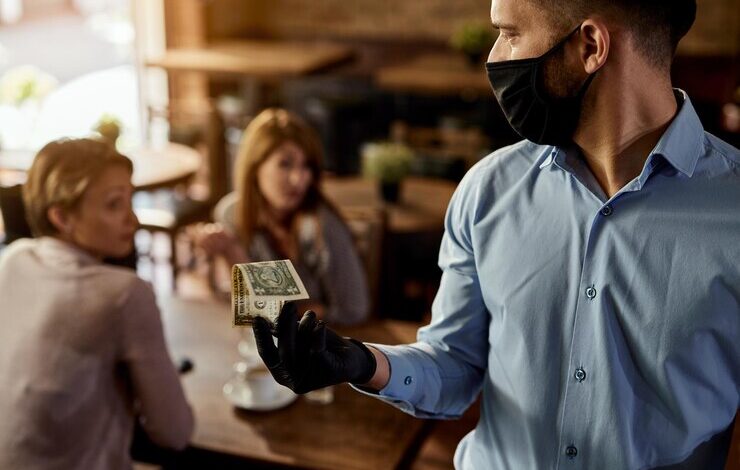

Merchant Cash Advances, commonly known as MCAs, are a popular financing answer for small businesses. Unlike traditional loans, MCAs provide a lump sum of capital in exchange for a percentage of future income. This flexibility permits companies to repay the development based totally on their sales flow.

MCAs are particularly useful for organizations with fluctuating incomes, which includes retail stores and restaurants. Instead of fixed month-to-month payments, payments vary with the enterprise’s overall performance. This can ease monetary strain at some point of slower months.

The concept of MCAs dates again to the early 2000s. Initially designed for companies that struggled to secure traditional loans, MCAs have on the grounds that evolved right into a mainstream financing choice. Today, businesses like Blursoft are main the rate in presenting available and innovative MCA solutions.

Understanding the Benefits of MCAs for Small Businesses

One of the maximum significant blessings of MCAs is the speed of funding. Traditional loans often require substantial office work, credit exams, and lengthy approval strategies. In evaluation, MCAs may be accredited and funded within days, making them best for businesses needing quick capital.

Another gain is the ability of repayments. Since payments are tied to future income, corporations only pay extra once they earn more. This removes the stress of fixed month-to-month bills and allows maintain coins glide for the duration of sluggish periods.

MCAs also have lenient eligibility standards. Businesses with negative credit histories or limited collateral can nevertheless qualify for an MCA. This inclusivity makes MCAs handy to a broader variety of groups, empowering them to develop and thrive.

How Blursoft Innovates inside the MCA Market

Blursoft is at the vanguard of innovation within the MCA market. Their streamlined software procedure and superior generation set them aside from competitors. With Blursoft, businesses can apply on-line and obtain a choice inside hours.

One of Blursoft’s key innovations is their use of data analytics. By studying a commercial enterprise’s sales records, Blursoft can offer customized MCAs tailor-made to the enterprise’s precise needs and sales styles. This personalised approach ensures that agencies get the maximum suitable financing answer.

Blursoft also prioritizes transparency and customer support. They offer clear phrases and situations, so companies know exactly what to expect. Their devoted aid crew is always available to assist with any questions or concerns, ensuring a smooth and pressure-free enjoy.

Success Stories of Businesses Using Blursoft MCAs

Many organizations have thrived thanks to Blursoft’s MCAs. Take, for instance, a small bakery in New York. Struggling with seasonal fluctuations, the bakery wanted short capital to cowl charges throughout the gradual winter months. Blursoft provided an MCA, permitting the bakery to live afloat and even amplify their product line.

Another success story is a family-owned restaurant in California. Facing sudden device upkeep, the restaurant wanted on the spot finances. Blursoft’s rapid approval and investment process saved the day, enabling the eating place to preserve serving customers without interruption.

These memories highlight the impact of Blursoft’s MCAs on small groups. By presenting well timed and flexible financing, Blursoft facilitates businesses triumph over demanding situations and acquire their goals.

A Detailed Guide on How to Apply for a MCA with Blursoft

Applying for an MCA with Blursoft is a straightforward process. First, companies want to fill out an internet application shape. The form calls for simple information about the commercial enterprise, including its sales records and sales styles.

Once the application is submitted, Blursoft’s team reviews the facts and analyzes the commercial enterprise’s income records. This evaluation facilitates decide the amount of the development and the repayment terms. Within hours, businesses receive a selection along side precise terms and situations.

If accredited, the budget are deposited into the business’s account within days. From there, companies can start using the capital to meet their needs. Repayments are automatically deducted from destiny income, making the method seamless and problem-unfastened.

Comparing Blursoft’s Offerings with Traditional Loans

When evaluating Blursoft’s MCAs with traditional loans, several key variations stand out. First, the approval process for MCAs is tons quicker. While traditional loans can take weeks or even months to approve, MCAs may be permitted and funded within days.

Another distinction is the power of repayments. Traditional loans have fixed month-to-month payments, no matter the enterprise’s overall performance. In comparison, MCA repayments are tied to sales, providing flexibility and easing cash waft management.

Traditional loans additionally have stricter eligibility criteria. Many small groups battle to qualify because of terrible credit or lack of collateral. Blursoft’s MCAs, alternatively, have extra lenient requirements, making them available to a much wider range of businesses.

Tips for Maximizing the Value of an MCA

To maximize the fee of an MCA, corporations should first conduct a radical evaluation of their monetary desires and sales styles. This will help decide the ideal amount of the improvement and make sure that payments are attainable.

It’s also crucial to apply the finances wisely. Businesses ought to prioritize crucial charges with the intention to generate revenue and help increase. Avoid using the price range for non-important purchases that may not make a contribution to the enterprise’s achievement.

Regularly reveal income and coins glide to make certain that repayments are on the right track. If there are any issues or adjustments in revenue, talk with Blursoft’s assist team. They can offer guidance and help to help manage repayments efficiently.

Conclusion

Merchant Cash Advances, specifically those provided by using Blursoft, are a game-changer for small companies. With their velocity, flexibility, and accessibility, MCAs provide a precious financing answer that helps increase and balance. Blursoft’s modern technique and dedication to customer service set them apart in the MCA market.